Starting a travel business is hard enough without having to deal with frozen accounts, high chargebacks, and other financial difficulties.

To protect your high-risk travel business from payment processor trouble, we put together this short guide to help you get approved for a high-risk travel merchant account in 2025.

What is a High-Risk Travel Merchant Account?

A high-risk merchant account is a specialized payment processing account designed for businesses that present a higher level of financial risk to credit card processors and banks.

In the case of the travel industry, businesses are labeled as high-risk due to specific operational risks, rather than the companies themselves being considered high-risk.

These risks include high average transaction values (often exceeding $500) and advanced purchases made months in advance.

Since people often purchase travel packages in advance, there is a higher propensity for chargebacks and fraud, resulting in a high-risk designation.

The key difference between a high-risk merchant account and a standard one is that the former often features stricter approval criteria, higher fees, and potentially rolling reserves to cover potential losses from chargebacks or fraud.

While standard accounts might impose transaction volume limits or caps on individual purchase amounts (often $500 or less), high-risk travel merchant accounts are designed to accommodate the larger ticket items common in travel, offering fewer restrictions on earning potential.

If you end up on a traditional payment processor and are then suddenly removed, you’ll suffer from lost sales, account freezes, and termination, which could severely hinder your travel merchant business.

Thankfully, Limitless Payment Solutions stands as your guide, ready to help you secure and optimize high-risk travel merchant accounts this year and for the years to come.

The 2025 Landscape for High-Risk Travel Merchants

The payment landscape for high-risk travel merchants in 2025 is continually evolving, presenting both new challenges and opportunities.

Staying informed about these shifts is crucial for maintaining seamless operations and securing approvals.

Increased Fraud and Chargebacks

The latest challenge for merchants worldwide is that scammers are increasingly leveraging AI to conduct sophisticated scams, including deepfakes and synthetic identities. These identities are used to create transactions, open accounts, and even bypass biometric identity checks.

There’s also the constant concern for travel merchant accounts: friendly fraud. According to data, friendly fraud is expected to increase even more in 2025 ,as it accounts for a large percentage of chargebacks already.

Evolving Payment Preferences

68% of travellers prefer credit cards and 52% debit cards for personal travel expenses opposed to cash. Merchants must adapt to these preferences to ensure a frictionless consumer experience and avoid lost sales due to unaccepted payment methods.

Regulatory Changes

The regulatory landscape for payment processing is in a state of constant flux, particularly for high-risk industries.

Notably, the PCI DSS v4.0 compliance deadline of March 31, 2025, introduces stricter requirements for web security, script management, and expanded Multi-Factor Authentication (MFA) for all access to cardholder data environments.

Global data privacy regulations, such as the GDPR, continue to influence how travel businesses collect, store, and transfer personal data, necessitating explicit consent and secure handling, particularly for international transactions.

Global Expansion

With the continued growth of international travel, there’s an increasing need for multi-currency support and robust international payment gateways.

Businesses that can process payments seamlessly in local currencies expand their market reach and enhance customer satisfaction, positioning themselves for success in diverse global markets.

Key Factors Underwriters Evaluate for High-Risk Travel Accounts in 2025

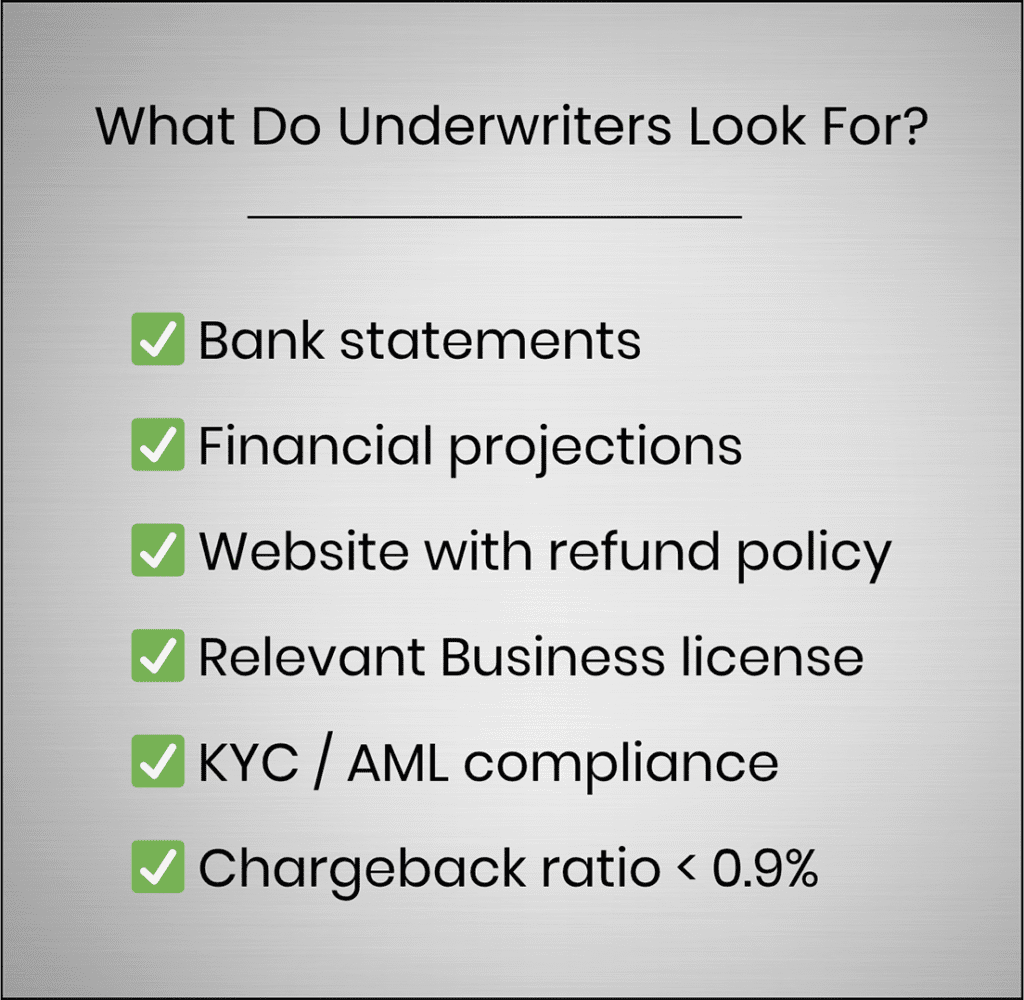

Underwriting involves a comprehensive evaluation of a merchant’s financial stability, operational practices, and industry-specific risks to determine eligibility and set appropriate terms for payment processing.

This process helps processors understand the potential for chargebacks, fraud, and financial instability before onboarding a new client.

Underwriters want to know that your travel business is stable, with a clear operational history and a business plan that outlines revenue models and growth strategies.

Depending on the history of your business, your personal credit scores may also be analyzed.

Another essential element for underwriters is your most recent bank statements and financial projections. They want to know your anticipated performance and ability to manage transactions.

Maintaining a chargeback ratio below 0.9% is the general line for approval, with an ideal target below 0.65%. Ratios exceeding this signal indicate insufficient fraud prevention or poor customer service.

Don’t forget your website.

A transparent website with easily accessible terms of service and clear refund policies helps manage customer expectations, significantly reducing instances of “friendly fraud” and chargebacks.

While you’re at it, prompt and effective customer service helps resolve issues directly with customers.

Travel businesses must adhere to all relevant industry-specific licenses and general regulatory requirements, including Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, to ensure legal operation and demonstrate credibility to underwriters.

Strategies for a Successful High-Risk Travel Merchant Account Application

Navigating the application process for a high-risk travel merchant account can be streamlined with a strategic approach.

- Compile a comprehensive package including your business license, recent bank statements, detailed processing history, and professional marketing materials.

- Present a well-structured plan that clearly outlines your business model, operational strategies, financial projections, and how you manage potential risks.

- Provide evidence of consistent revenue, healthy cash flow, and a solid financial standing.

- Detail the specific tools and strategies you employ to minimize chargebacks and detect fraudulent activities.

- Emphasize your commitment to customer satisfaction through easily accessible terms and conditions, clear refund policies, and efficient dispute resolution processes.

- Openly disclose any past processing issues or chargeback history: Honesty about previous challenges, coupled with a clear explanation of the steps taken to rectify them and prevent recurrence, builds trust with underwriters.

The best way to get started is by calling Limitless Payment Solutions today. You’ll get to speak with an experienced high-risk merchant account service provider who can get you connected with a payment processor quickly without the fear of a frozen account.

For a complete list of application documents, check out our high-risk merchant account checklist.

Have a Travel Business? Set Up a High-Risk Merchant Account with Limitless Payment Solutions Today.

Struggling to find the right payment processor? Contact Limitless Payment Solutions today, and one of our experts will work with you to get your high-risk travel merchant account set up.

We work with all types of high-risk businesses, including kratom, peptides, and more. Fill out our form or call us for a free consultation.