The travel industry presents unique financial complexities, especially when it comes to accepting payments.

For many travel merchants, standard payment processing solutions are often out of reach, guiding them towards what is known as “high-risk” payment processing.

But why? Our guide helps you understand why travel merchants are labeled high-risk, and the best options for choosing a high-risk merchant account.

High-Risk Payment Processing for Travel Merchants

The journey of a travel business involves not just crafting unforgettable experiences for customers but also navigating the often choppy waters of financial transactions.

What is High-Risk Payment Processing? (And Why Your Travel Business Might Need It)

High-risk payment processing is a specialized financial service designed for businesses that, according to banks and payment processors, are more likely to encounter chargebacks or fraudulent activities.

This classification is not necessarily a negative reflection on the legitimacy or operational integrity of the business itself.

Industries with a documented history of high chargeback volumes or significant instances of fraud, such as the travel industry, inherently represent a greater potential for financial loss to these institutions.

This classification is less about the individual merit of a travel business and more about the statistical risk profile associated with its entire sector.

Is Your Travel Business Considered High-Risk?

The travel industry, encompassing travel agencies, tour operators, and related businesses, is frequently categorized as high-risk.

Travel merchant accounts typically involve high transaction volumes and substantial individual transaction amounts, both of which lead to high-risk designations by traditional payment processors.

Sometimes, it’s entirely preemptive, based on industry-wide statistics, even for new businesses that have not yet developed a processing history.

Payment processors will utilize historical data from the travel sector, which indicates significant annual losses due to chargebacks and fraud, to assess future risk and may even outright deny payment processing entirely.

That’s why a majority of travel merchants work with high-risk merchant accounts like Limitless Payment Solutions.

Why the Travel Industry is a High-Risk Hotspot

The travel industry’s unique operational model, characterized by advanced bookings, a global scope, and reliance on a complex network of suppliers, contributes to its high-risk status in the realm of payment processing.

Here are the primary factors that lead travel merchants to be classified as high-risk.

High Chargeback Rate

A chargeback occurs when a customer disputes a transaction with their card-issuing bank, which then reverses the charge and refunds the customer.

The travel industry is particularly plagued by chargebacks, losing an estimated $25 billion annually to chargebacks and fraud.

Recent data indicates a significant surge in travel-related disputes, with a reported 30% year-over-year increase according to some sources.

Several factors contribute to the high rate of chargebacks in travel:

- Card-Not-Present (CNP) Transactions – A majority of travel bookings, including flights, hotel stays, and tour packages (such as those offered by Airbnb and timeshares), are conducted online or via mobile devices making them more susceptible to chargebacks.

- Service Dissatisfaction and Misunderstandings – Customers may initiate chargebacks if the services received do not meet their expectations or if they misunderstand the terms and conditions, particularly cancellation policies.

- Friendly Fraud – Friendly fraud occurs when customers dispute legitimate charges, often after having already used the service, or as a means to circumvent cancellation fees they agreed to but may not have fully understood. It’s estimated that 6% of hospitality revenue is lost annually to fraud, with friendly fraud being the primary driver.

- True Fraud – The use of stolen credit card details to make unauthorized travel bookings also contributes to chargeback volumes.

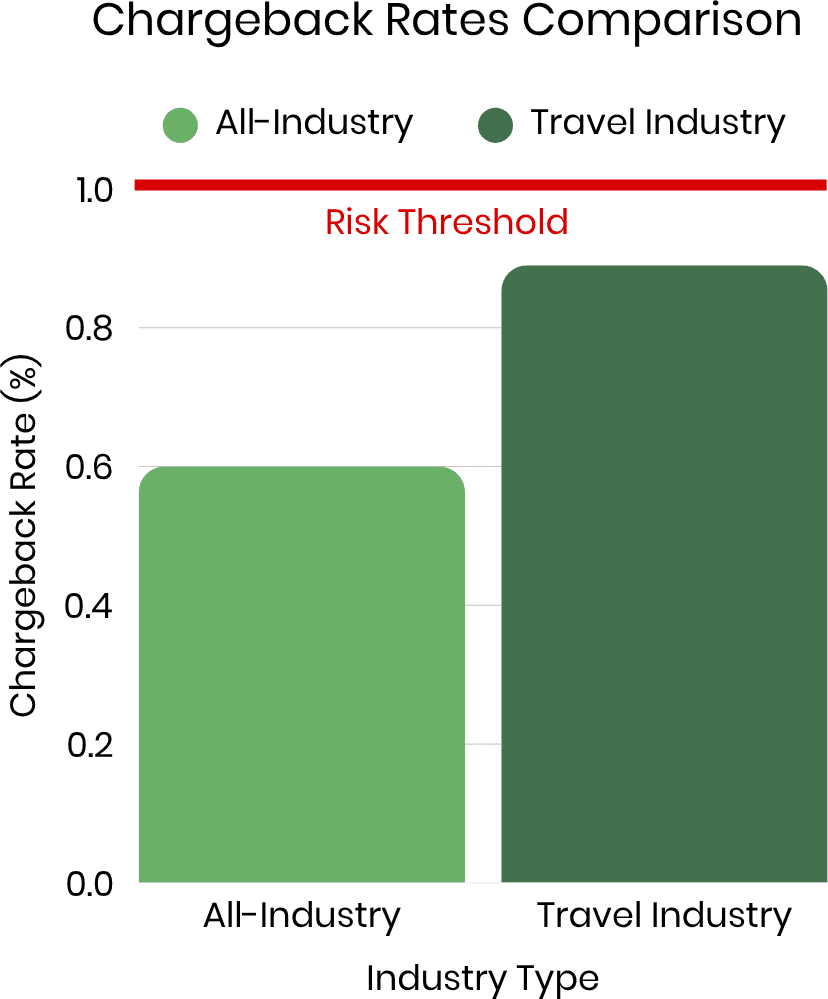

Generally, a chargeback rate exceeding 1% of transactions is considered the maximum allowable threshold by many processors, after which they may impose severe restrictions, higher fees, or even account termination.

The travel industry’s average chargeback rate is approximately 0.89%, which, while below the critical 1% mark, is significantly higher than the all-industry average of 0.60% and uncomfortably close to the threshold that triggers heightened scrutiny.

Advance Bookings and Extended Liability

A defining characteristic of the travel industry is that services are frequently purchased months, or even longer, in advance of their actual delivery.

This practice of “deferred delivery” creates an extended window between the customer’s payment and the provision of the travel service.

This time lag inherently increases risk, as numerous unforeseen circumstances can arise for the customer, such as illness or a change in personal plans, leading to cancellations or payment disputes.

Payment processors bear a significant portion of the liability during this extended period.

This long gap between payment and service consumption in travel creates a unique “inventory risk” for payment processors, which is distinct from a simple transaction risk seen in retail, where goods are typically exchanged quickly.

This makes it more challenging for new or less financially robust travel businesses to secure favorable payment processing terms.

High-Ticket Transactions for Travel Merchant Accounts

Travel-related purchases, such as airline tickets, vacation packages, and cruise bookings, often involve substantial sums of money.

While high-ticket sales are beneficial for overall revenue, they simultaneously mean that each chargeback or fraudulent transaction results in a proportionally larger financial loss for the merchant and, by extension, the payment processor.

The combination of high transaction values and the prevalence of Card-Not-Present (CNP) environments in the travel sector makes robust, multi-layered fraud detection and prevention measures critical.

Industry Volatility and Dependencies

Beyond chargebacks, advance bookings, international complexities, and high-ticket sales, other factors contribute to the travel industry’s high-risk profile.

Travel businesses operate within a complex ecosystem and are often heavily reliant on a chain of third-party suppliers, including airlines, hotels, ground transport providers, and local tour operators.

The failure or underperformance of a key supplier directly impacts a travel business’s ability to deliver the promised services, potentially leading to mass cancellations and a surge in chargebacks, even if the merchant itself is operationally sound.

And don’t forget the unexpected. The travel industry is uniquely vulnerable to a wide range of external shocks, including global pandemics, natural disasters, geopolitical instability, and economic downturns.

Such events trigger widespread travel disruptions, cancellations, and an overwhelming volume of refund requests and chargebacks.

A processor not equipped to handle sudden, massive spikes in dispute volumes or lacking sufficient capital reserves could face financial instability, thereby impacting all its merchants.

Therefore, when a travel business selects a payment processor, it is also, in effect, assessing that processor’s capacity to weather industry-wide storms.

Why Limitless is the Ideal Payment Partner for Your Travel Business

Limitless Payment Solutions recognizes that travel businesses need more than just a generic payment gateway; they require tailored strategies and unwavering support.

We understand that “travel” is not a monolithic industry.

The payment needs of an Online Travel Agency (OTA) differ from those of a bespoke tour operator, an adventure travel company, or a luxury resort.

We don’t believe in one-size-fits-all solutions.

Instead, we take the time to understand the specific nuances of your business model and customize our merchant account services accordingly. This approach ensures that the solution aligns perfectly with your operational flow and risk profile, addressing the kind of differentiation noted in industry discussions.

Rapid dispute resolution systems include an early alert system empowering you to protect your hard-earned revenue effectively.

At Limitless Payment Solutions, we believe in building long-term partnerships based on trust and transparency.

Our ultimate goal is to handle the complexities of payment processing, allowing you to dedicate your energy and resources to what you do best: creating exceptional travel experiences for your customers.

Take the Next Step Towards Worry-Free Travel Payments

The journey through the world of high-risk payment processing can seem daunting, but with the right partner, it becomes manageable and even empowering.

Limitless Payment Solutions understands the unique pressures and opportunities within the travel industry and is committed to providing secure, reliable, and tailored payment solutions that protect your revenue.

Ready to secure your revenue and streamline your travel payments? Contact Limitless Payment Solutions today for a free, no-obligation consultation.