The travel industry is exhilarating, fast-paced, and full of opportunity.

However, when it comes to payment processing, it’s also one of the most misunderstood and unfairly penalized industries.

If you’ve ever tried to open a merchant account for your travel business, you’ve probably run into roadblocks, vague rejections, or sky-high fees. Unfortunately, banks and processors won’t tell you why they’re denying you, but Limitless Payment Solutions will.

We’re going to pull back the curtain on the travel merchant account industry to help you understand why your business is considered high-risk, how to get approved faster (and with better terms), and everything else banks and payment processors don’t want you to know.

In this post, we’ll pull back the curtain on the travel merchant account industry and explain:

Why Travel Businesses are Considered High-Risk

There are four key reasons why travel merchants are labeled high-risk: long fulfillment windows, high chargeback rates, international transactions, and regulatory complexities.

Unfortunately, some of these issues are inherent to the travel industry. You can’t change customers’ booking trips in advance or for international travel, which means the high-risk label isn’t a fair description of your actual business practices.

Long Fulfillment Windows

Travel services are often booked months in advance. As a result, there is a delay between payment and service.

For a bank, this means there are risks, especially if the trip is canceled or the business goes bankrupt. In that case, it’s the bank that’s on the hook for the bill, not anyone else.

High Chargeback Rates

Travel is one of the top industries for chargebacks.

Customers dispute charges for everything from canceled flights to bad hotel experiences, all things that have nothing to do with the merchant itself.

If you’re in the travel industry, expect chargebacks to occur; however, implementing rapid dispute resolution and other security measures can help lower that ratio.

International Transactions

Travel businesses often deal with cross-border payments, which increases fraud risk and complicates compliance.

Regulatory Complexity

Traveling across borders and state lines complicates things.

From DOT regulations to international travel laws, the compliance landscape is complex and unclear. Banks would rather avoid dealing with that hassle if possible.

What Banks and Processors Won’t Tell You

Most banks and processors won’t come out and say, “We don’t want your business.”

Instead, they’ll give you vague reasons or simply ghost you after you apply. It doesn’t help that when you apply with a bank, you might be speaking with 10 different people who know nothing about your business, nor do they care to.

Here’s just some of the things banks aren’t telling you:

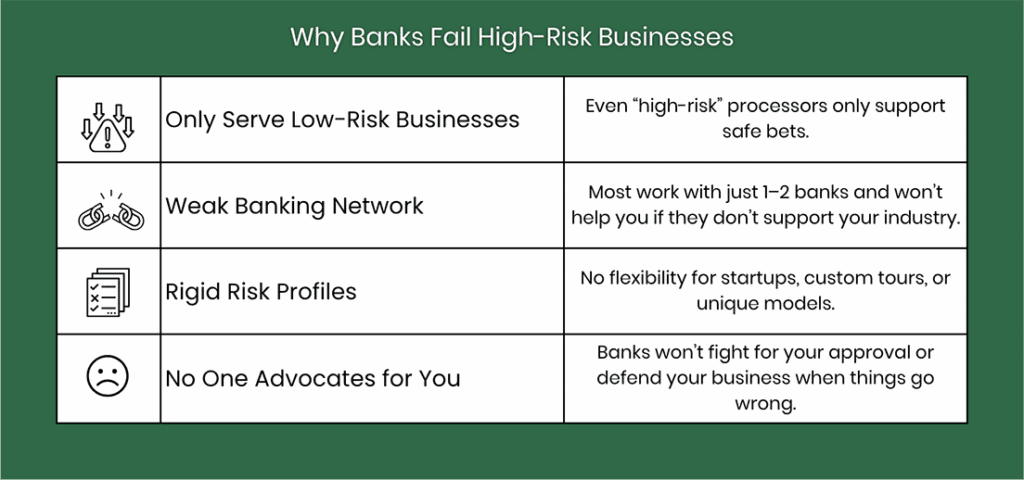

Banks and Processors Only Work with Low-Risk Businesses

Even if they advertise “high-risk processing,” many processors only support industries like e-commerce or digital goods. This does not include travel.

Banks and Processors Don’t Have the Right Banking Relationships

For many processors, they rely on a small number of acquiring banks. If none of those banks accept travel merchants, you’re out of luck.

Banks and Processors Can’t Customize Your Risk Profile

Banks use rigid underwriting guidelines.

If your business doesn’t fit the mold, like if you’re a startup or offering custom tours, they won’t take the time to understand your model.

Banks and Processors Are Not Going to Fight for You

When push comes to shove, you want a bank and payment processor that will fight for you. Your finances are the most crucial aspect of keeping your business afloat.

You should know that banks and processors don’t advocate for your approval or back you up if things go awry.

If your application raises a red flag, they move on to the next one.

What Happens if My Travel Business Gets Rejected

Here’s something most people don’t realize: every time you get rejected for a merchant account, it leaves a trail. And that trail can come back to haunt you.

It’s kind of like when you apply for multiple credit cards; each application dings your score a little bit more. When you apply to multiple processors or banks for your business and get denied each time, you’re not just wasting time. You’re creating a negative pattern.

Underwriters talk. Banks share data. If your business has been turned down four or five times, the next underwriter in line is going to ask:

“Why did everyone else say no? What do they know that I don’t?”

Now the underwriter has a decision to make.

Do they take a chance on you and risk being the one who approved a “problem file”? Or do they play it safe and pass?

Nine times out of ten, they pass.

But when you work with Limitless, we don’t shotgun your application to every bank on the planet. We curate your submission, send it to the right partner the first time, and protect your reputation in the process.

The team at Limitless Payment Solutions works to set your business up the right way, the first time.

In High-Risk, It’s Not Just What You Know—It’s Who You Know

Let’s be honest: the high-risk merchant account world isn’t exactly a meritocracy.

It’s a relationship game. And we’ve been playing it for over 20 years.

We know which underwriters are open to travel businesses this quarter. We know which banks are tightening up and which ones are expanding. We know who’s flexible on reserves, who’s fast on approvals, and who’s just going to waste your time.

You could try to figure all that out yourself, applying to a ton of banks, or you could just work with someone who already knows the playbook.

Think of us as your backstage pass to the high-risk payments industry.

We know the bouncers. We know the VIP list. And we’ll get you in the door.

The Limitless Payment Solutions Difference

We are your best ally in the high-risk world of travel merchant accounts.

1. We Work with Multiple Banks

We’re not tied to a single processor or bank.

We’ve built relationships with a network of acquiring banks that specialize in high-risk verticals, including travel, peptides, and kratom.

That means we can match your business with the bank most likely to approve you, based on your size, model, and risk profile.

2. We Understand the Travel Industry

We’ve worked with:

- Tour operators

- Cruise lines

- Vacation rental platforms

- Travel agencies

- Booking engines

- Destination management companies

We understand the challenges you face and how to effectively present your business to ensure approval.

3. We Package Your Application for Success

We don’t just submit your paperwork. We help you:

- Prepare your financials

- Write a compelling business summary

- Address risk factors proactively

- Provide supporting documents that banks want to see

4. We Negotiate Better Terms

Because we work with multiple banks, we can negotiate:

- Lower processing fees

- Reduced rolling reserves

- Faster funding times

- Chargeback protection tools

5. We Save You Time and Headaches

Instead of applying to five processors and getting rejected five times, you apply once—with us.

We handle the rest.

Don’t Let Payment Processing Hold You Back. Contact Limitless Payment Solutions Today

You’ve built a business that helps people explore the world. Don’t let outdated banking policies keep you grounded.

At Limitless Payment Solutions, we specialize in high-risk merchant accounts for travel businesses. We know the banks. We know the red flags. And we know how to get you approved—fast.

Apply now for your high-risk merchant account.